Global Factoring Services Market Outlook

According To Renub Research factoring services market has become an increasingly important component of modern business finance, offering companies an alternative way to manage cash flow and working capital requirements. Factoring is a financial arrangement in which businesses sell their accounts receivable to a third party, known as a factor, at a discount in exchange for immediate liquidity. This mechanism allows organizations to bridge the gap between invoicing and customer payment, ensuring smoother operations and improved financial stability.

Factoring services are particularly attractive to small and medium-sized enterprises, which often face challenges in accessing traditional bank credit due to limited collateral or credit history. As global trade expands and payment cycles lengthen, factoring has emerged as a practical solution for businesses seeking flexibility, speed, and risk mitigation. The market is further strengthened by digital platforms and fintech innovations that simplify onboarding, credit assessment, and transaction processing, making factoring more accessible across industries and regions.

Global Factoring Services Market Size and Forecast

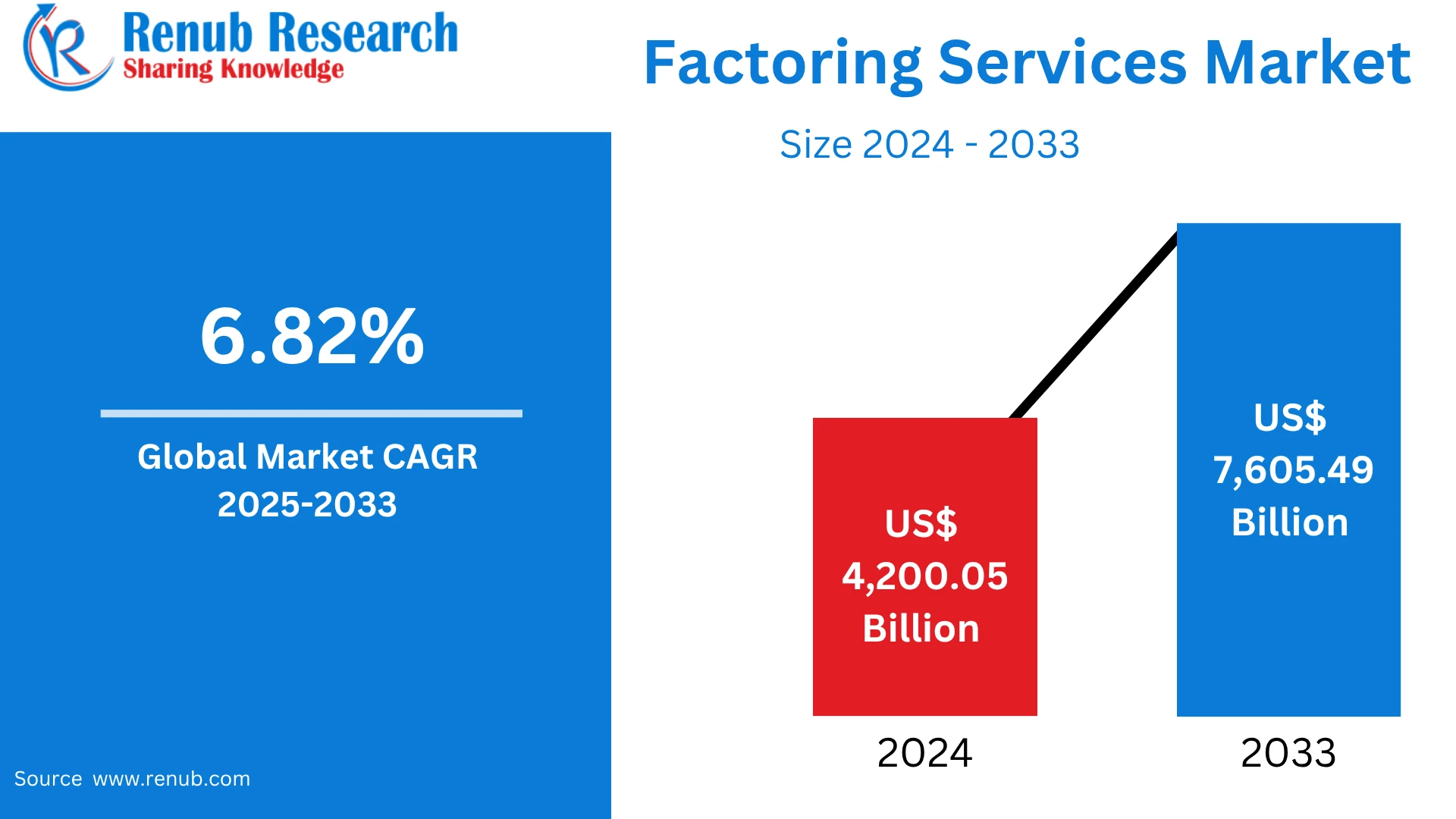

The global factoring services market is projected to register strong growth between 2025 and 2033. The market, valued at approximately US$ 4,200.05 billion in 2024, is expected to reach around US$ 7,605.49 billion by 2033. This expansion represents a compound annual growth rate of about 6.82% during the forecast period.

Growth is being driven by increasing reliance on alternative financing solutions, rising demand for efficient cash flow management, and the continued expansion of international trade. Emerging markets, in particular, are contributing significantly to market expansion as financial infrastructure improves and awareness of invoice-based financing increases. With businesses prioritizing liquidity and operational efficiency, factoring services are expected to maintain a strong upward trajectory globally.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=factoring-services-market-p.php

Role of Factoring Services in Business Finance

Factoring services play a vital role in supporting day-to-day business operations by converting outstanding invoices into immediate cash. Unlike traditional loans, factoring does not add debt to a company’s balance sheet, making it an attractive option for firms seeking non-debt financing. This approach enables businesses to meet payroll, purchase inventory, invest in growth, and manage operational expenses without waiting for customer payments.

In addition to liquidity support, factoring services often include credit risk management, collections, and ledger administration. By outsourcing these functions to professional factors, businesses can focus on core activities while reducing administrative burden. Factoring also enhances financial predictability, which is especially valuable for companies operating in industries with long payment cycles or seasonal demand fluctuations.

Key Drivers of Growth in the Global Factoring Services Market

Rising Working Capital Needs among SMEs

Small and medium-sized enterprises account for a significant share of global economic activity, yet they frequently encounter cash flow constraints due to delayed payments and limited access to conventional financing. Factoring provides SMEs with a fast and flexible way to unlock capital tied up in receivables, enabling them to sustain operations and pursue growth opportunities.

Governments and financial institutions across many regions are actively supporting SME financing initiatives, further encouraging the adoption of factoring services. As SME ecosystems continue to expand in both developed and emerging economies, their growing dependence on factoring is a major contributor to overall market growth.

Expansion of International Trade and Cross-Border Transactions

Globalization of supply chains and the rise of cross-border trade have significantly increased the need for international factoring services. Businesses engaged in export and import activities often face extended payment terms, currency risks, and credit uncertainties. International factoring helps mitigate these challenges by providing liquidity, managing foreign receivables, and reducing credit risk associated with overseas customers.

The growth of e-commerce and cross-border business-to-business transactions has further amplified demand for export and import factoring. As international trade volumes rise, factoring services are becoming an essential financial tool for maintaining cash flow and supporting global business expansion.

Increasing Adoption of Fintech and Digital Factoring Platforms

Technological advancement is transforming the factoring services market by improving efficiency, transparency, and scalability. Digital factoring platforms leverage automation, data analytics, and artificial intelligence to streamline credit assessment, invoice verification, and payment processing. These innovations significantly reduce turnaround times and operational costs.

Fintech-driven solutions are also expanding access to factoring in underserved markets, where traditional financial services may be limited. As digital adoption accelerates globally, factoring services are becoming more secure, user-friendly, and widely accepted, driving deeper market penetration across industries.

Challenges in the Global Factoring Services Market

Regulatory Complexity and Cross-Border Legal Constraints

Factoring operations are subject to varying regulatory frameworks across different countries, creating challenges for providers operating internationally. Differences in legal systems, documentation requirements, data protection laws, and receivables assignment rules can complicate cross-border transactions.

Lack of standardization increases compliance costs and may discourage smaller businesses from using international factoring services. Navigating these regulatory complexities remains a key challenge, particularly for SMEs with limited resources and financial expertise.

Perception of High Costs and Credit Risk Exposure

Despite its benefits, factoring is sometimes perceived as an expensive financing option due to service fees and discount rates. Some businesses also express concern about reputational risk when customer collections are managed by third-party factors.

From the provider’s perspective, credit risk assessment and management remain critical challenges, especially during periods of economic uncertainty. Increased default risk can affect profitability and limit aggressive market expansion. Addressing cost transparency and improving risk management practices are essential for sustained market confidence.

Global Banks Factoring Services Market

Banks play a prominent role in the global factoring services market by offering integrated financial solutions to businesses. Their strong capital base, regulatory compliance, and established customer relationships enable them to provide factoring services at competitive terms.

Many banks are expanding their factoring offerings through digital channels, making services more accessible and efficient. For businesses seeking secure and scalable financing solutions, banks remain a preferred choice, particularly for large enterprises and established SMEs.

Global SMEs Factoring Services Market

The SME segment represents the largest user base for factoring services worldwide. These businesses often face challenges in securing traditional bank loans, making factoring an attractive alternative for managing liquidity.

Factoring services are widely used by SMEs in manufacturing, wholesale, logistics, and services sectors, where payment delays are common. As global SME participation in trade and supply chains increases, demand for factoring solutions is expected to grow steadily.

Domestic Factoring Services Market

Domestic factoring involves financing receivables within a single country, where legal and regulatory environments are consistent. This segment is generally considered lower risk compared to international factoring and involves simpler processes.

Domestic factoring is widely adopted by local businesses to stabilize cash flow and manage operational expenses. Government initiatives promoting financial inclusion and SME development further support growth in this segment across many regions.

Construction Factoring Services Market

The construction industry is characterized by long project cycles and delayed payments, making factoring a valuable financing tool. Contractors and subcontractors use factoring to manage cash flow, cover labor costs, and purchase materials while awaiting project payments.

As infrastructure development and public-private partnership projects expand globally, construction factoring services are gaining importance. This segment is expected to continue growing as construction firms seek alternatives to traditional borrowing.

Healthcare Factoring Services Market

Healthcare providers often experience delays in payments from insurers and government agencies, leading to cash flow challenges. Factoring allows hospitals, clinics, and medical suppliers to convert receivables into immediate funds, ensuring continuity of operations.

With the global healthcare sector expanding due to aging populations and increased service demand, healthcare factoring is becoming a critical financing solution. Specialized factoring providers that understand regulatory and billing complexities are driving adoption in this segment.

United States Factoring Services Market

The United States represents one of the largest and most mature factoring markets globally. A strong SME base, high volume of business-to-business transactions, and advanced financial infrastructure support widespread adoption of factoring services.

Key industries utilizing factoring in the U.S. include manufacturing, transportation, healthcare, and staffing. Fintech innovation continues to enhance service delivery, making factoring faster and more transparent. Regulatory clarity and market maturity support sustained growth in the country.

Germany Factoring Services Market

Germany has a well-established factoring market supported by its export-driven economy and strong industrial base. The country’s small and medium-sized enterprises, commonly referred to as the Mittelstand, frequently use factoring to manage liquidity and mitigate trade risks.

Germany also serves as a hub for cross-border factoring within Europe, benefiting from regulatory harmonization. Increasing digital adoption and focus on sustainable business practices continue to strengthen the factoring landscape in the country.

India Factoring Services Market

India’s factoring services market is expanding rapidly due to SME growth, supply chain digitalization, and supportive government initiatives. Platforms designed to improve receivables financing accessibility are helping businesses address chronic working capital challenges.

Fintech firms are playing a crucial role in increasing awareness and adoption of factoring, particularly among underserved SMEs. Regulatory improvements and rising demand for invoice-based financing are creating a strong foundation for long-term market growth in India.

Saudi Arabia Factoring Services Market

Saudi Arabia’s factoring market is gaining momentum as part of the country’s economic diversification and SME development efforts under Vision 2030. Regulatory reforms and increased digital banking adoption are creating a favorable environment for factoring providers.

Industries such as construction, healthcare, and logistics are increasingly using factoring to improve liquidity and reduce reliance on traditional loans. Continued focus on financial inclusion and non-oil sector growth is expected to drive further expansion of the factoring market in Saudi Arabia.

Market Segmentation Overview

The global factoring services market is segmented by provider, enterprise size, application, and end user. Providers include banks and non-banking financial companies, while enterprise size is divided between large enterprises and SMEs. Applications are categorized into domestic and international factoring, addressing different financing needs.

End-use industries include construction, manufacturing, healthcare, transportation and logistics, energy and utilities, IT and telecom, staffing, and other service sectors. This broad segmentation highlights the versatility and widespread applicability of factoring services across global business environments.

Competitive Landscape and Key Players

The global factoring services market features a competitive landscape comprising banks, specialized financial institutions, and fintech-driven providers. Market participants focus on digital transformation, risk management, and geographic expansion to strengthen their market presence. Competitive analysis typically includes company overviews, leadership strategies, recent developments, SWOT assessments, and revenue analysis.

Prominent players operating in the market include Eurobank Ergasias SA, Deutsche Factoring Bank, Barclays PLC, BNP Paribas, Mizuho Financial Group Inc., and RTS Financial Service Inc..

Future Outlook of the Global Factoring Services Market

The future of the global factoring services market is closely linked to digital innovation, SME growth, and expanding global trade. As businesses increasingly prioritize liquidity and financial flexibility, factoring is expected to gain wider acceptance as a mainstream financing solution.

Advancements in fintech, improved regulatory frameworks, and rising participation from emerging markets will further shape market dynamics. With strong demand across industries and regions, the global factoring services market is well positioned for sustained growth through 2033, playing a critical role in supporting global business activity and economic resilience.