ATM Market Trends, Deployment, and Forecast 2025–2033

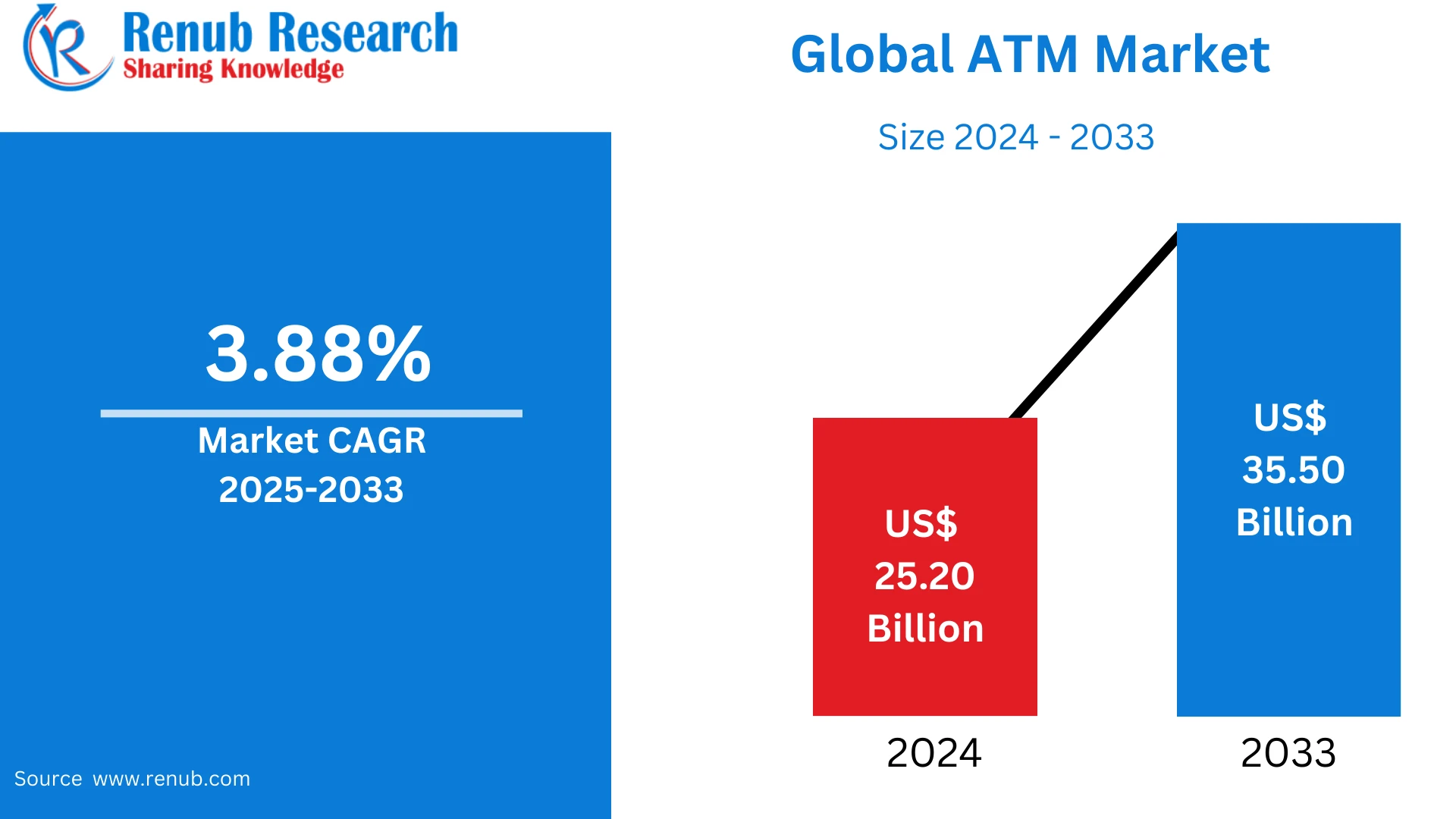

According To Renub Research global ATM market continues to evolve as financial institutions adapt to changing consumer behavior and advancing digital technologies. Valued at approximately US$ 25.20 billion in 2024, the market is expected to reach nearly US$ 35.50 billion by 2033, expanding at a CAGR of 3.88% between 2025 and 2033. Despite the rapid rise of digital payment platforms, ATMs remain a vital component of the global banking infrastructure, particularly in regions where cash transactions dominate everyday commerce. Growing financial inclusion initiatives, technological modernization, and expansion in emerging economies are sustaining long-term market growth.

Global ATM Industry Overview

An Automated Teller Machine (ATM) is a self-service electronic banking terminal that allows users to perform essential financial transactions without assistance from bank personnel. These services include cash withdrawals, balance inquiries, deposits, and fund transfers. ATMs are deployed across a wide range of locations such as bank branches, retail outlets, transportation hubs, and rural areas, ensuring uninterrupted access to banking services.

By enabling self-service banking, ATMs significantly reduce pressure on traditional bank branches while improving operational efficiency. They serve as a bridge between physical cash usage and digital banking platforms, particularly for populations that lack full access to online financial services. Their reliability, availability, and ease of use have made ATMs a long-standing pillar of the global financial ecosystem.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=atm-market-p.php

ATM Market Trends and Industry Evolution

One of the most prominent trends in the ATM market is the transition toward smart and contactless machines. Technologies such as Near Field Communication, biometric authentication, and cardless withdrawals are increasingly being integrated to enhance security and customer convenience. These innovations support faster transactions, improved hygiene, and reduced fraud risks.

Another notable trend is the growing adoption of managed ATM services and ATM-as-a-Service models. Banks are increasingly outsourcing ATM deployment, maintenance, and cash management to third-party providers to reduce costs and improve service efficiency. Additionally, white-label ATMs are expanding rapidly in underserved and remote regions, helping improve access to financial services beyond traditional banking networks.

Key Drivers of ATM Market Growth

Convenience and Accessibility

ATMs offer unmatched convenience by providing 24/7 access to cash and essential banking services. Unlike physical bank branches with limited operating hours, ATMs accommodate customers with varying schedules and urgent financial needs. Their strategic placement in urban centers, workplaces, rural regions, and high-traffic public locations ensures widespread accessibility, particularly for individuals without immediate access to bank branches.

Digital Transformation of Banking Infrastructure

The rapid digitization of the banking sector has significantly influenced ATM evolution. Modern ATMs now support mobile banking integration, contactless cards, and biometric verification, aligning them with digital-first consumer expectations. These advancements allow ATMs to remain relevant as hybrid platforms that support both cash-based and digital transactions.

Technological Advancements

Continuous innovation in hardware and software has enhanced ATM efficiency and security. Features such as predictive maintenance, real-time monitoring, advanced encryption, and anti-skimming technologies reduce downtime and fraud risks. These technological improvements increase trust among users while lowering operational costs for service providers, thereby supporting sustained market growth.

Challenges in the ATM Market

Declining Cash Usage

The increasing adoption of digital wallets, mobile payment applications, and cashless transaction systems poses a challenge to ATM transaction volumes. In developed economies, reduced dependence on cash has impacted ATM utilization rates, making profitability a concern for operators. This shift requires ATM providers to reassess deployment strategies and focus on regions where cash demand remains strong.

Regulatory and Compliance Requirements

ATM operators face stringent regulatory requirements related to data security, accessibility standards, and financial compliance. Adhering to evolving regulations often requires frequent software updates, hardware upgrades, and employee training, leading to higher operating expenses. Non-compliance can result in financial penalties and reputational damage, making regulatory adherence a critical operational priority.

United States ATM Market Overview

The United States represents one of the largest ATM markets globally, supported by an extensive nationwide network. While digital payment adoption continues to rise, cash remains an important payment method for small businesses, informal transactions, and specific demographic groups. The market is evolving through enhanced security systems, mobile banking integration, and cardless transaction capabilities, ensuring ATMs remain relevant in the modern financial environment.

India ATM Market Overview

India’s ATM market is expanding steadily due to strong demand for cash transactions and government-led financial inclusion initiatives. The widespread deployment of bank-owned and white-label ATMs has improved access to banking services in rural and semi-urban areas. Technological upgrades, improved security measures, and interoperability between banks continue to strengthen India’s ATM ecosystem and support inclusive economic growth.

United Kingdom ATM Market Overview

The UK ATM market is undergoing structural changes as digital payments gain popularity and traditional bank branches decline in number. While overall ATM deployment has decreased, demand for cash remains significant in rural communities and among elderly populations. Shared-service ATMs and innovative access-to-cash initiatives are emerging to ensure continued availability of cash-based services.

United Arab Emirates ATM Market Overview

The ATM market in the United Arab Emirates is characterized by steady growth supported by advanced digital infrastructure and progressive financial policies. Increased adoption of cardless withdrawals, biometric authentication, and contactless technologies reflects the country’s focus on secure and efficient banking services. These developments align with broader national goals of financial modernization and digital transformation.

ATM Market Segmentation by Solution

By solution, the ATM market is divided into deployment and managed services. Deployment includes online ATMs, offline ATMs, worksite ATMs, and mobile ATMs, each designed to meet specific operational and geographic requirements. Managed services encompass outsourced activities such as cash handling, maintenance, monitoring, and software management.

ATM Market Segmentation by Type

Based on type, the market is categorized into white-label and brown-label ATMs. White-label ATMs are operated by non-bank entities and play a crucial role in expanding banking access in underserved regions. Brown-label ATMs involve partnerships between banks and service providers, offering a balanced model of control and efficiency.

ATM Market Segmentation by Application

ATM applications include cash withdrawals, deposits, and fund transfers. Cash withdrawals remain the primary use case, while deposit-enabled and multifunctional ATMs are gaining traction as banks aim to offer broader self-service capabilities.

Regional and Country-Level Outlook

The global ATM market spans North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Growth patterns vary by region depending on cash dependency, technological adoption, regulatory frameworks, and economic development. Emerging economies, particularly in Asia Pacific and Africa, are expected to drive future market expansion through large-scale deployment and financial inclusion initiatives.

Competitive Landscape and Key Players

The ATM market is highly competitive, with major players focusing on innovation, partnerships, and geographic expansion. Key companies include Diebold Nixdorf Incorporated, NCR Corporation, HESS Cash Systems GmbH, Hitachi Channel Solutions Corp., Fujitsu, GRG Banking, Source Technologies, and Hyosung TNS Inc.. These companies continue to shape the future of the ATM industry through technological innovation, service diversification, and strategic expansion.