Australia Vegan Food Market Overview

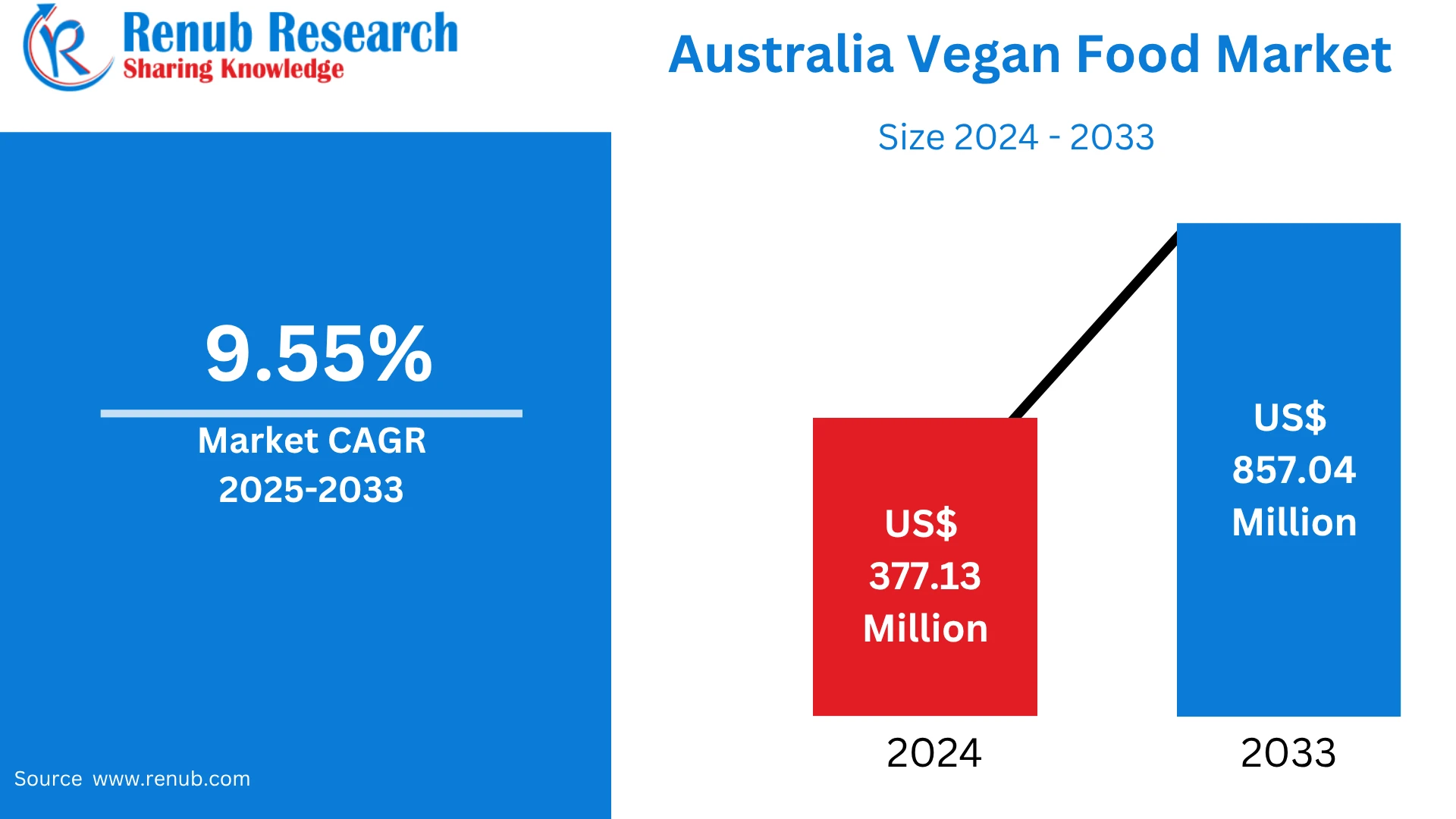

According To Renub Research Australia vegan food market is experiencing strong and sustained growth, reflecting a fundamental transformation in consumer attitudes toward health, sustainability, and ethical consumption. Valued at US$ 377.13 million in 2024, the market is projected to reach approximately US$ 857.04 million by 2033, expanding at a CAGR of 9.55% from 2025 to 2033. This growth highlights Australia’s position as a rapidly evolving plant-based food market within the Asia–Pacific region.

Rising participation from millennials and Generation Z is a major factor behind this expansion. These consumers are more open to alternative diets and prioritize environmental and ethical considerations in their purchasing decisions. Increased awareness of lactose intolerance, lifestyle-related health issues, and food sensitivities has further accelerated demand. In parallel, strong retail penetration and the growth of online sales channels have improved product availability, encouraging broader adoption of vegan food across the country.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=australia-vegan-food-market-p.php

Australia Vegan Food Industry Landscape

Vegan food excludes all animal-derived ingredients such as meat, dairy, eggs, and honey, relying solely on plant-based sources. Common ingredients include fruits, vegetables, grains, legumes, nuts, seeds, and plant proteins. These foods are typically rich in fiber, antioxidants, vitamins, and essential minerals, supporting balanced nutrition and long-term health benefits.

In Australia, vegan food has evolved from a niche category into a mainstream dietary option. The industry now spans dairy alternatives, meat substitutes, ready meals, snacks, desserts, and functional foods. Advances in food technology have significantly enhanced product taste, texture, and nutritional content, allowing vegan products to compete directly with conventional animal-based foods.

Changing Consumer Preferences and Dietary Trends

Australian consumers are increasingly adopting flexible dietary habits rather than strict veganism. Flexitarian diets, which prioritize plant-based meals while allowing occasional meat consumption, are gaining popularity. This approach appeals to consumers seeking health and sustainability benefits without fully eliminating animal products from their diets.

Younger demographics are especially influential in driving these trends. Millennials and Generation Z are more experimental with food, highly engaged on digital platforms, and receptive to sustainability messaging. Social media, documentaries, and public health discussions have normalized plant-based eating, helping vegan food gain acceptance across diverse age and income groups.

Health Consciousness Driving Market Growth

Health awareness is one of the most powerful drivers of the vegan food market in Australia. A growing number of Australians are reducing meat consumption to lower the risk of chronic conditions such as heart disease, obesity, diabetes, and certain cancers. Plant-based diets are widely associated with improved digestion, lower cholesterol levels, and overall wellness.

Demand for plant-based meat and dairy alternatives has surged as consumers seek familiar foods with improved nutritional profiles. Manufacturers are responding by fortifying products with protein, calcium, vitamin B12, iron, and other essential nutrients. This focus on health-oriented innovation continues to attract both dedicated vegans and health-conscious omnivores.

Environmental Sustainability and Climate Considerations

Environmental awareness plays a significant role in shaping consumer behavior within the Australian vegan food market. Livestock farming is increasingly associated with greenhouse gas emissions, deforestation, and excessive water use. As climate change concerns grow, many consumers view plant-based diets as a practical way to reduce their environmental impact.

Plant-based foods generally require fewer resources and generate lower emissions than animal-based products. This environmental advantage resonates strongly with younger consumers, who are more likely to support brands that promote sustainability. As a result, vegan food companies often emphasize eco-friendly sourcing, responsible production methods, and sustainable packaging to strengthen brand appeal.

Ethical Motivations and Animal Welfare Concerns

Ethical considerations related to animal welfare are another key driver of vegan food adoption in Australia. Greater transparency in the food supply chain and increased media exposure of animal farming practices have heightened public concern. Many consumers are actively seeking cruelty-free food options that align with their moral values.

Vegan food provides an ethical alternative that allows consumers to enjoy familiar meals without contributing to animal exploitation. This shift extends beyond individual households, influencing restaurants, foodservice providers, and institutional buyers to include more plant-based options in their offerings.

Product Innovation and Industry Advancement

Innovation is central to the growth of the Australian vegan food industry. Companies are investing heavily in research and development to enhance flavor, texture, shelf life, and nutritional balance. Technological progress has led to plant-based meat products that closely replicate the sensory experience of animal meat, increasing acceptance among mainstream consumers.

Beyond meat and dairy substitutes, the market is expanding into functional foods, high-protein snacks, plant-based seafood alternatives, and indulgent vegan desserts. This diversification supports sustained consumer interest and reduces reliance on a limited product range, strengthening overall market resilience.

Key Challenges in the Australia Vegan Food Market

Despite strong growth prospects, the market faces notable challenges. One of the most significant barriers is the higher cost of vegan products compared to traditional foods. Specialized ingredients, smaller-scale production, and complex processing often result in premium pricing, limiting accessibility for budget-conscious consumers.

Taste and texture perceptions also remain a concern for some buyers, particularly first-time users of plant-based alternatives. Although product quality has improved considerably, lingering skepticism persists. Addressing these challenges will require continued innovation, greater production efficiency, and increased competition to help reduce prices and improve consumer confidence.

Recent Developments in the Australian Vegan Food Industry

Recent developments highlight the accelerating maturity of the vegan food market in Australia. New domestic production facilities for plant-based ingredients have strengthened local supply chains and reduced reliance on imports. These investments support cost reduction, product consistency, and long-term industry growth.

Additionally, the launch of carbon-neutral plant-based meat products at competitive price points has addressed key consumer concerns around affordability and sustainability. Such developments demonstrate the industry’s ability to respond effectively to evolving consumer expectations.

Market Segmentation by Product Type

The Australian vegan food market is segmented into dairy alternatives, meat substitutes, and other product categories. Dairy alternatives, including plant-based milk, cheese, yogurt, and spreads, hold a substantial market share due to high lactose intolerance rates and strong consumer familiarity. Meat substitutes represent the fastest-growing segment, driven by demand for burgers, sausages, mince, and ready-to-cook products. Other segments include snacks, desserts, sauces, and specialty vegan foods.

Market Segmentation by Source

By source, the market includes almond, soy, oats, wheat, and other plant-based ingredients. Almond and oat-based products are widely favored for their taste and health perception. Soy remains a major protein source, particularly in meat alternatives, while wheat-based ingredients are commonly used for texture and structure. Innovation is expanding the use of alternative sources such as peas, lentils, and chickpeas.

Distribution Channel Overview

Distribution channels are critical to market expansion. Supermarkets and hypermarkets dominate sales due to their broad reach and extensive product assortments. Convenience stores and specialty retailers cater to niche and impulse purchases, while online stores are experiencing rapid growth driven by digital adoption and home delivery services. E-commerce platforms enable direct-to-consumer sales and subscription models, enhancing brand loyalty.

Competitive Landscape and Key Market Players

The Australian vegan food market is moderately competitive, featuring both international and domestic companies. Key players include Beyond Meat Inc., Danone S.A, The Archer Daniels Midland Company, Tofutti Brands Inc., Vitasoy Australia Products Pty Ltd., SunOpta, and Daiya Foods, Inc..

These companies compete through product innovation, sustainability initiatives, pricing strategies, and expanded distribution networks. Investments in local manufacturing and strategic partnerships further strengthen their market positions.

Future Outlook of the Australia Vegan Food Market

The future outlook for the Australian vegan food market remains highly positive. Growth will continue to be supported by rising health awareness, environmental responsibility, ethical consumption, and improved product accessibility. As production scales and competition intensifies, prices are expected to become more competitive, encouraging wider adoption.

Ongoing advancements in food technology, improved nutritional formulations, and deeper collaboration between manufacturers and retailers will shape the next phase of market development. With strong consumer demand and continuous innovation, the Australia vegan food market is well positioned for sustained growth through 2033 and beyond.