Global Embolic Protection Device Market Analysis - Growth Trends and Forecast (2025-2033)

Market Overview

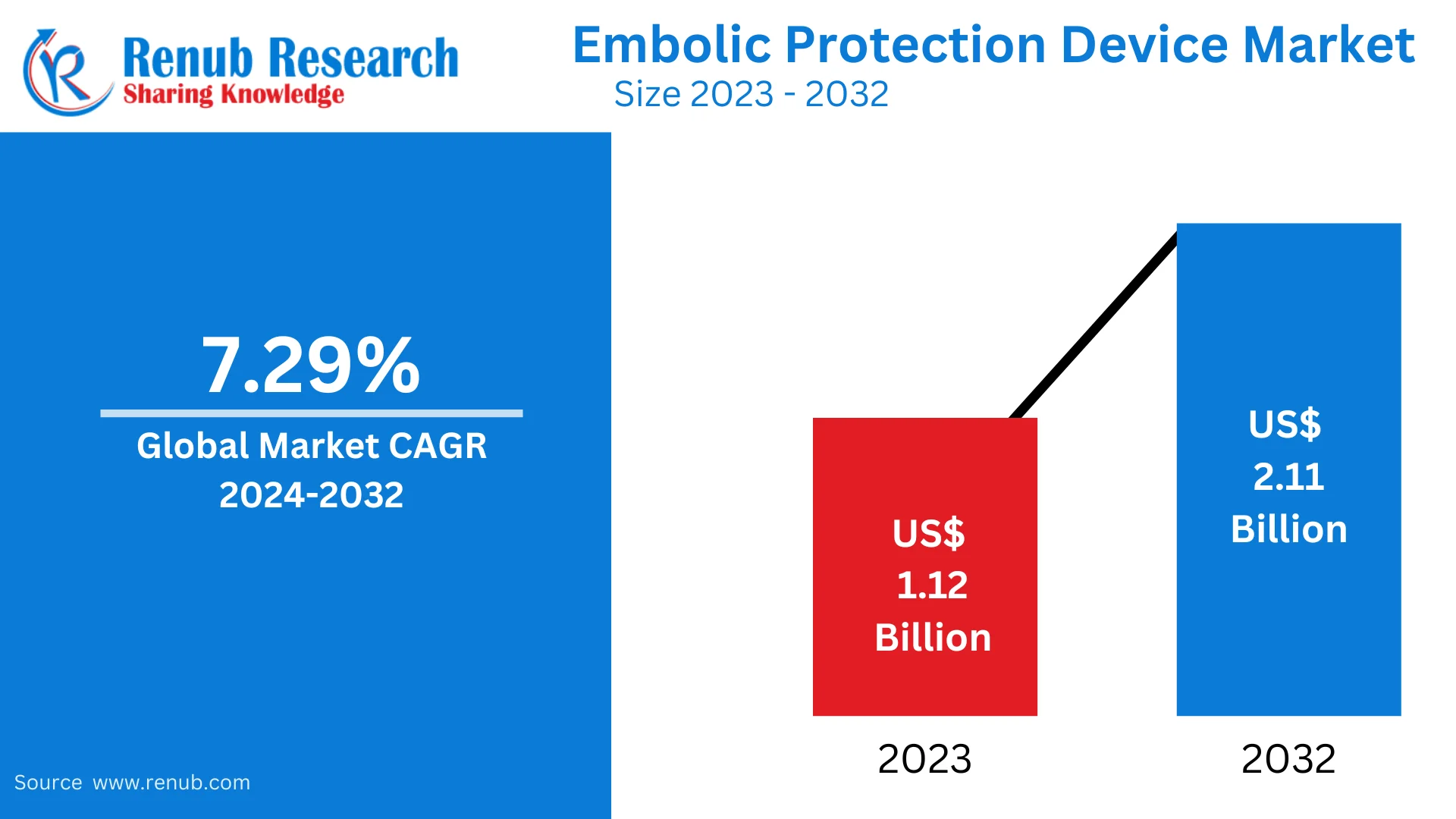

The global Embolic Protection Device (EPD) Market was valued at USD 1.18 billion in 2024 and is projected to reach USD 2.18 billion by 2033, growing at a compound annual growth rate (CAGR) of 7.07% from 2025 to 2033. The market is driven by several key factors including the increasing prevalence of cardiovascular diseases (CVDs), technological advancements in minimally invasive procedures, and the growing adoption of embolism protection devices across various medical applications globally.

Key Market Drivers

- Increasing Incidence of Cardiovascular Diseases

- Cardiovascular diseases are one of the leading causes of death worldwide. Factors such as aging populations, unhealthy lifestyle choices, and poor diet have contributed to the rising prevalence of heart-related conditions, such as atherosclerosis, coronary artery disease, and strokes. Consequently, the need for embolic protection devices has surged, particularly during procedures like carotid artery stenting (CAS) and transcatheter aortic valve replacement (TAVR).

- Ongoing advancements in medical device technology have made embolism protection devices more efficient and safer for patients. Innovations such as nitinol frameworks, advanced filter designs, and sophisticated retrieval mechanisms have improved the efficiency of embolic debris capture. These innovations are critical for reducing post-operative complications and ensuring faster recovery.

- Minimally invasive procedures are rapidly gaining preference due to their shorter recovery times, lower risk, and minimal scarring. EPDs are pivotal in these procedures, particularly in vascular interventions and interventional cardiology, where their role in preventing embolic debris from causing strokes and heart attacks is paramount.

Market Segmentation Analysis

- By Product Type

- Distal Filter Devices: These are the most commonly used EPDs, capturing embolic debris during cardiovascular and neurovascular interventions. Their wide use in carotid artery stenting and percutaneous coronary interventions (PCI) is a major factor driving market growth.

- Distal Occlusion Devices: These are used in specific situations where the goal is to occlude a vessel to prevent embolism. They are gaining popularity due to their high efficiency in specific vascular procedures.

- Proximal Occlusion Devices: Used in areas where embolic protection is critical, especially during TAVR procedures.

- Coronary Artery Treatment: As the burden of coronary artery disease continues to rise, the demand for EPDs in coronary interventions grows, helping prevent embolic debris during stent implantations and atherectomy.

- Carotid Artery Treatment: The increasing prevalence of carotid artery stenosis, a leading risk factor for stroke, is driving demand for EPDs in carotid artery stenting procedures.

- Nitinol: Due to its biocompatibility, flexibility, and self-expanding properties, nitinol-based devices are preferred for their ability to trap embolic debris effectively without obstructing blood flow.

- Polyurethane: This material is used in some EPDs for its durability and flexibility, although it is less common than nitinol.

- Disposable Devices: These are gaining traction due to their lower risk of infection and contamination, with single-use devices enhancing safety during procedures. They are primarily used in hospitals and ambulatory surgical centers.

- Re-Usable Devices: While offering cost-effectiveness over the long term, re-usable devices require stringent sterilization protocols and have higher associated costs.

- Hospitals and Clinics: The largest segment, as these institutions perform the highest volume of cardiovascular and neurovascular procedures.

- Ambulatory Surgical Centers: As a growing alternative to hospitals, these centers are increasingly adopting EPDs for outpatient procedures.

Related Report

Regional Insights

- United States

- The U.S. leads the market due to its advanced healthcare infrastructure, high adoption of minimally invasive procedures, and a large base of medical device companies. Reimbursement policies and patient awareness are driving demand, particularly for TAVR and carotid artery stenting procedures.

- Countries like France, Germany, and the United Kingdom have seen increased adoption of embolism protection devices, spurred by rising cardiovascular disease rates and a strong healthcare system. In 2024, Silk Road Medical's CGuard Embolic Prevention Carotid Stent was approved for reimbursement in France, demonstrating the region’s commitment to advancing medical technology.

- The Asia-Pacific market is expanding rapidly, with India and China showing significant growth. India’s increasing healthcare awareness and government programs for cardiac care are accelerating the demand for EPDs. In China, the rising prevalence of cardiovascular diseases and rapid healthcare expansion is fostering market growth.

- The Middle East, particularly Saudi Arabia, is witnessing growth driven by the country's heavy investments in healthcare infrastructure. The increasing prevalence of hypertension, obesity, and diabetes is contributing to the rise in cardiovascular procedures, thus creating demand for EPDs.

Challenges Facing the Market

- High Costs

- The high cost of EPDs and associated procedures remains a significant barrier, especially in low- and middle-income countries where healthcare spending is limited. The R&D costs for advanced devices also contribute to the high price, making affordability a challenge.

- The approval process for new devices in major markets such as the U.S. and EU is lengthy, often involving rigorous clinical trials and compliance with stringent regulatory standards. This can delay the entry of new technologies into the market, adding to the overall cost.

Key Companies in the Market

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic Inc.

- Edwards Lifesciences Corporation

- Silk Road Medical Inc.

These companies are leaders in the development and innovation of embolic protection devices, continually improving the safety and efficacy of these critical medical tools.

Conclusion

The Global Embolic Protection Device Market is expected to continue its growth trajectory, driven by the increasing burden of cardiovascular diseases, technological advancements, and the shift towards minimally invasive procedures. While the market presents opportunities for growth, challenges such as cost and regulatory approval delays could impede its pace. Nonetheless, ongoing advancements and the increasing focus on patient safety will likely drive the adoption of EPDs, ensuring their continued presence as critical tools in cardiovascular, neurovascular, and peripheral vascular interventions.