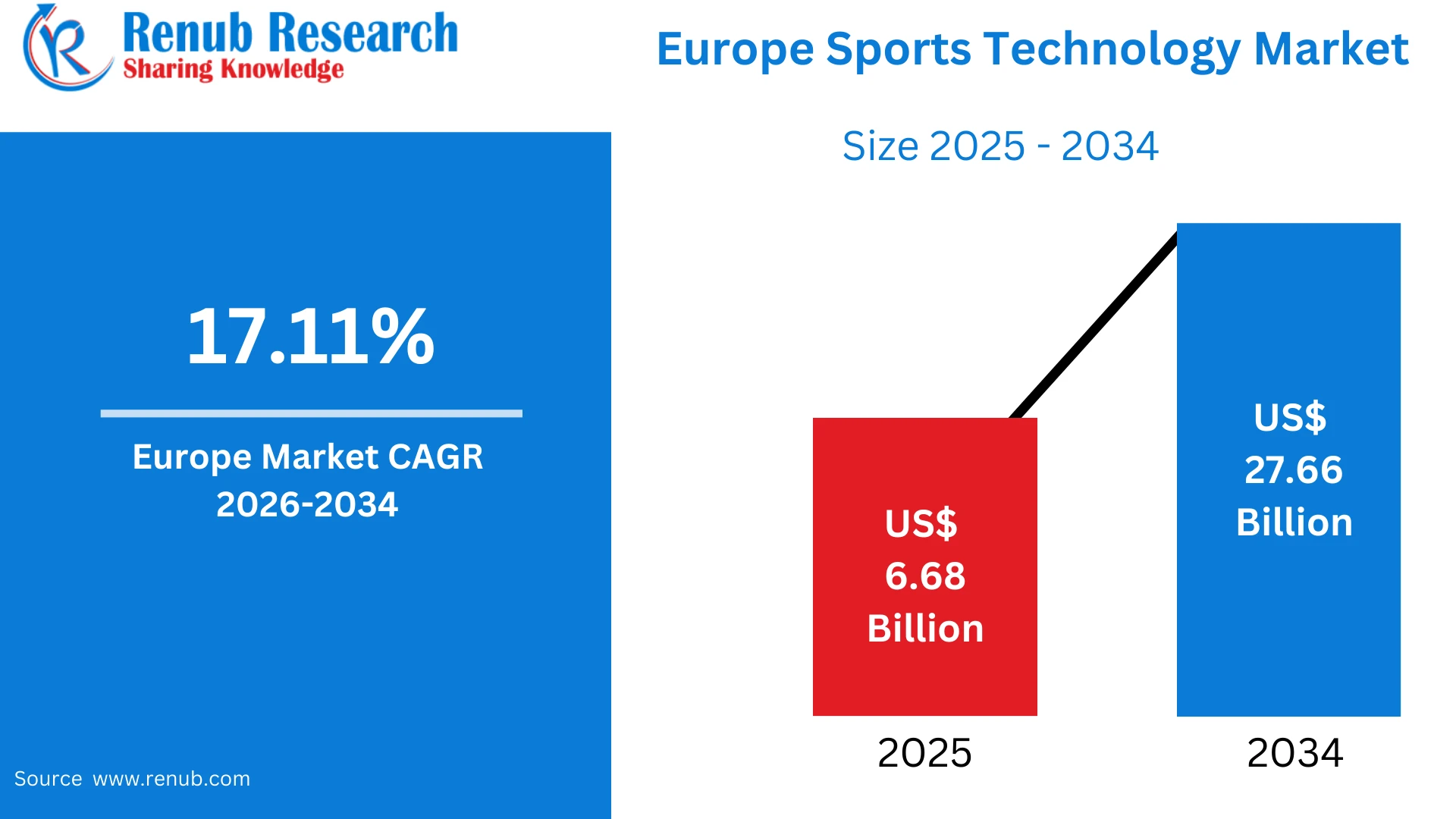

Europe Sports Technology Market Size & Forecast 2026–2034

According to Renub Research Europe sports technology market is entering a high-growth phase, supported by rapid digital transformation across professional sports, fitness, and fan engagement ecosystems. The market is projected to expand from US$ 6.68 billion in 2025 to US$ 27.66 billion by 2034, registering a compound annual growth rate (CAGR) of 17.11% between 2026 and 2034. This growth reflects rising investments in advanced analytics, wearable technologies, artificial intelligence, smart stadium infrastructure, and connected fitness platforms. Europe’s deeply rooted sporting culture, combined with strong institutional support for innovation and sports science, positions the region as one of the most influential sports technology markets globally.

Download Free Sample Report:https://www.renub.com/request-sample-page.php?gturl=europe-sports-technology-market-p.php

Europe Sports Technology Market Outlook

Sports technology refers to the application of digital tools, software platforms, hardware systems, and data-driven methodologies designed to enhance athletic performance, training efficiency, sports management, and fan experiences. In Europe, sports technology spans wearable devices, GPS trackers, performance analytics software, video analysis systems, virtual and augmented reality tools, injury prevention technologies, and smart stadium solutions.

The adoption of sports technology has accelerated as clubs, leagues, and training institutions seek competitive advantages through data-driven decision-making. Beyond elite sports, recreational athletes and fitness enthusiasts are increasingly using connected devices and mobile applications to monitor health, track performance, and personalize workouts. At the same time, stadium operators and broadcasters are deploying digital solutions to improve engagement, optimize operations, and unlock new revenue streams. Together, these trends form a robust foundation for long-term market expansion.

Growth Drivers in the Europe Sports Technology Market

Professionalization of Sports and Performance Optimization

The professionalization of sports at all levels is a core driver of technology adoption in Europe. Elite clubs, national teams, and academies invest heavily in wearable sensors, GPS tracking systems, biomechanical analysis tools, and video analytics platforms to improve player performance and reduce injury risk. These technologies provide granular insights into workload, movement patterns, and tactical behavior, enabling coaching staff to optimize training and match preparation.

As competition intensifies across football, rugby, basketball, athletics, and cycling, data-driven performance management has become a strategic necessity rather than a luxury. Clubs increasingly view sports technology as a long-term investment that enhances consistency, player longevity, and talent development.

Digital Fan Engagement, Media Innovation, and Commercialization

Fan engagement has undergone a structural shift, driven by mobile consumption, streaming platforms, and social media. European clubs and leagues now use sports technology to deliver immersive digital experiences, including live data overlays, advanced broadcast graphics, fantasy sports integrations, and personalized content. Smart stadium solutions such as digital ticketing, mobile ordering, and augmented reality experiences enhance matchday satisfaction while generating valuable behavioral insights.

From a commercial perspective, these technologies enable better monetization of media rights, sponsorships, and digital inventory. As European sports organizations increasingly operate as global entertainment brands, technology plays a central role in audience growth and revenue diversification.

Growth of Fitness, Wellness, and Connected Consumer Devices

The rising focus on health and wellness across Europe has significantly expanded the consumer side of the sports technology market. Smartwatches, fitness trackers, connected gym equipment, and mobile health applications allow users to monitor activity levels, heart rate, sleep, and recovery. Home fitness platforms and virtual coaching services combine convenience with gamified experiences, attracting a broad demographic.

This consumer-driven demand has created a large installed base of Internet of Things (IoT) devices and subscription-based services. As everyday users gain access to performance metrics once limited to elite athletes, the boundary between professional and recreational sports technology continues to blur.

Challenges in the Europe Sports Technology Market

High Costs, ROI Uncertainty, and Budget Constraints

Despite strong growth potential, high costs remain a significant barrier, particularly for smaller clubs, amateur organizations, and grassroots sports. Advanced tracking systems, analytics platforms, and immersive training tools require substantial upfront investment, ongoing maintenance, and specialized staff. Measuring return on investment can be challenging, especially in areas such as injury prevention or youth development where outcomes are long-term.

Budget constraints in lower leagues often limit adoption, creating a technology gap between elite and grassroots levels. Vendors are increasingly addressing this challenge through modular solutions, cloud-based platforms, and flexible pricing models.

Data Privacy, Integration Complexity, and Skills Gap

Sports technology generates large volumes of sensitive data related to athletes, fans, and operations. Ensuring data privacy, cybersecurity, and regulatory compliance is a growing concern, particularly when handling biometric information. Integrating multiple systems—wearables, video platforms, ticketing software, and analytics tools—into a unified ecosystem is technically complex and costly.

Many organizations lack in-house expertise to manage data pipelines and analytics effectively. Additionally, cultural resistance from traditional coaching environments can limit adoption if technology is perceived as replacing intuition rather than supporting it.

Europe Sports Technology Software Market

Software forms the backbone of the Europe sports technology market by transforming raw data into actionable insights. Performance analytics platforms aggregate information from GPS trackers, wearables, and video systems to support tactical analysis, load management, scouting, and rehabilitation. On the commercial side, customer relationship management systems and fan engagement platforms manage ticketing, memberships, and digital campaigns.

Cloud-based deployment has become standard, enabling collaboration across teams and locations. Broadcasters rely heavily on real-time data visualization software to enhance storytelling and viewer engagement, further reinforcing the importance of software solutions within the market.

Europe Sports Technology Services Market

The services segment includes consulting, system integration, data analysis, and managed operations. Many European clubs and federations rely on external specialists to design data strategies, implement technology, and train staff. Sports scientists and performance consultants translate data into actionable recommendations for training and injury prevention.

On the commercial side, service providers support fan data management, personalization strategies, and digital marketing campaigns. Education and training services are also critical, ensuring that coaches and athletes can effectively use advanced tools.

Europe IoT Sports Technology Market

IoT-based sports technology includes wearable devices, smart equipment, connected gym machines, and stadium sensors. European teams widely use GPS vests, heart-rate monitors, and inertial sensors to capture real-time performance data. Smart stadiums deploy IoT solutions to manage crowd flow, environmental conditions, and asset utilization.

For consumers, IoT devices encourage daily engagement with fitness and wellness. Reliability, battery efficiency, comfort, and secure data handling are essential factors influencing adoption and long-term use.

Europe Soccer Sports Technology Market

Football is the dominant sport driving sports technology adoption in Europe. Leading clubs invest heavily in tracking systems, video analytics, and sports science platforms to optimize tactics, manage physical load, and prevent injuries. Data-driven scouting and recruitment have become standard practices, helping clubs identify undervalued talent globally.

Fan-facing technologies such as interactive apps, augmented reality experiences, and advanced broadcast graphics strengthen engagement and global brand reach. Given the competitive nature of European football, technology is viewed as a strategic asset across all levels.

Europe Cricket Technology Market

Cricket technology in Europe is more specialized, with strong adoption in the United Kingdom, Ireland, and emerging markets across the continent. Ball-tracking systems, high-speed cameras, and performance analytics software support technique refinement and injury management. Broadcast innovations, including predictive graphics and real-time statistics, enhance viewer understanding, particularly in shorter formats such as T20 cricket.

Europe Analytics and Statistics Sports Technology Market

Analytics and statistics underpin modern decision-making in European sports. Event data, tracking metrics, and contextual information are used to evaluate players, tactics, and recruitment targets. On the business side, analytics inform ticket pricing, sponsorship valuation, and content strategies.

Progressive clubs and leagues increasingly build internal data science teams, while vendors provide customizable analytics platforms and dashboards tailored to specific sports and organizational needs.

Europe Sports Training Technology Market

Training-focused sports technology enhances skill acquisition, tactical awareness, and technique development. Video coaching platforms, motion capture systems, and virtual reality simulators allow athletes to practice scenarios repeatedly and receive instant feedback. Youth academies use these tools to standardize development methodologies, while individual sports benefit from detailed biomechanical analysis to reduce injury risk.

France Sports Technology Market

France’s sports technology market is shaped by strong traditions in football, rugby, cycling, and Olympic disciplines. Professional clubs and national teams extensively use tracking systems, video analysis, and sports science tools. Rugby and cycling, in particular, rely heavily on performance metrics and workload management. Digital fan engagement platforms and enhanced broadcast solutions are widely adopted to strengthen supporter relationships.

United Kingdom Sports Technology Market

The United Kingdom represents one of the most advanced sports technology markets in Europe. Football clubs, cricket organizations, rugby teams, and Olympic programs invest heavily in analytics, tracking, and injury prevention technologies. The UK also hosts a vibrant ecosystem of sports technology startups focused on analytics, wearables, fan engagement, and coaching platforms.

Germany Sports Technology Market

Germany’s sports technology market benefits from strong engineering capabilities, structured leagues, and close collaboration between clubs, universities, and technology companies. Bundesliga football clubs are early adopters of tracking and analytics systems, while other sports such as handball, winter sports, and motorsports leverage precision measurement and engineering-led innovation.

Market Segmentations

The Europe sports technology market is segmented by component into software, wearable devices and sports equipment, and services. By technology, it includes artificial intelligence and machine learning, IoT, and augmented and virtual reality. Sports segments cover soccer, baseball, basketball, ice hockey, rugby, tennis, cricket, golf, e-sports, and others. Applications include tracking, analytics, training, tactics, and injury management. End users range from coaches and clubs to leagues and sports associations across major European countries.

Competitive Landscape and Company Analysis

The competitive landscape features global and regional players offering end-to-end solutions across performance, analytics, and fan engagement. Key companies include Catapult Group International Ltd., Garmin Ltd., Infosys Limited, International Business Machines Corporation, Oracle Corporation, Pixellot Ltd., SAP SE, Stats Perform, and Zebra Technologies Corporation. Each company is evaluated across five viewpoints: overview, key personnel, recent developments, SWOT analysis, and revenue performance, highlighting the competitive intensity and innovation focus within the European sports technology market.